what is a bull flag in technical analysis

This article will discuss what a bull. A bull flag is used in the technical analysis of stocks.

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

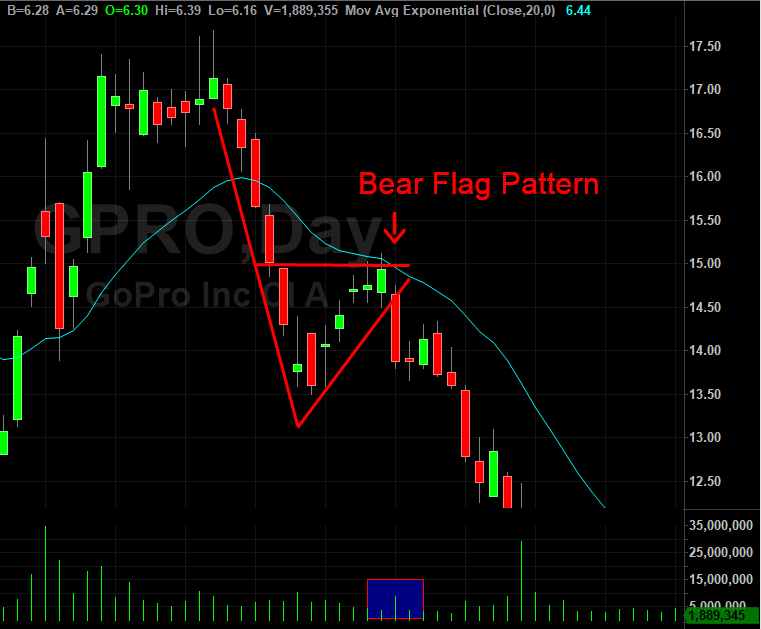

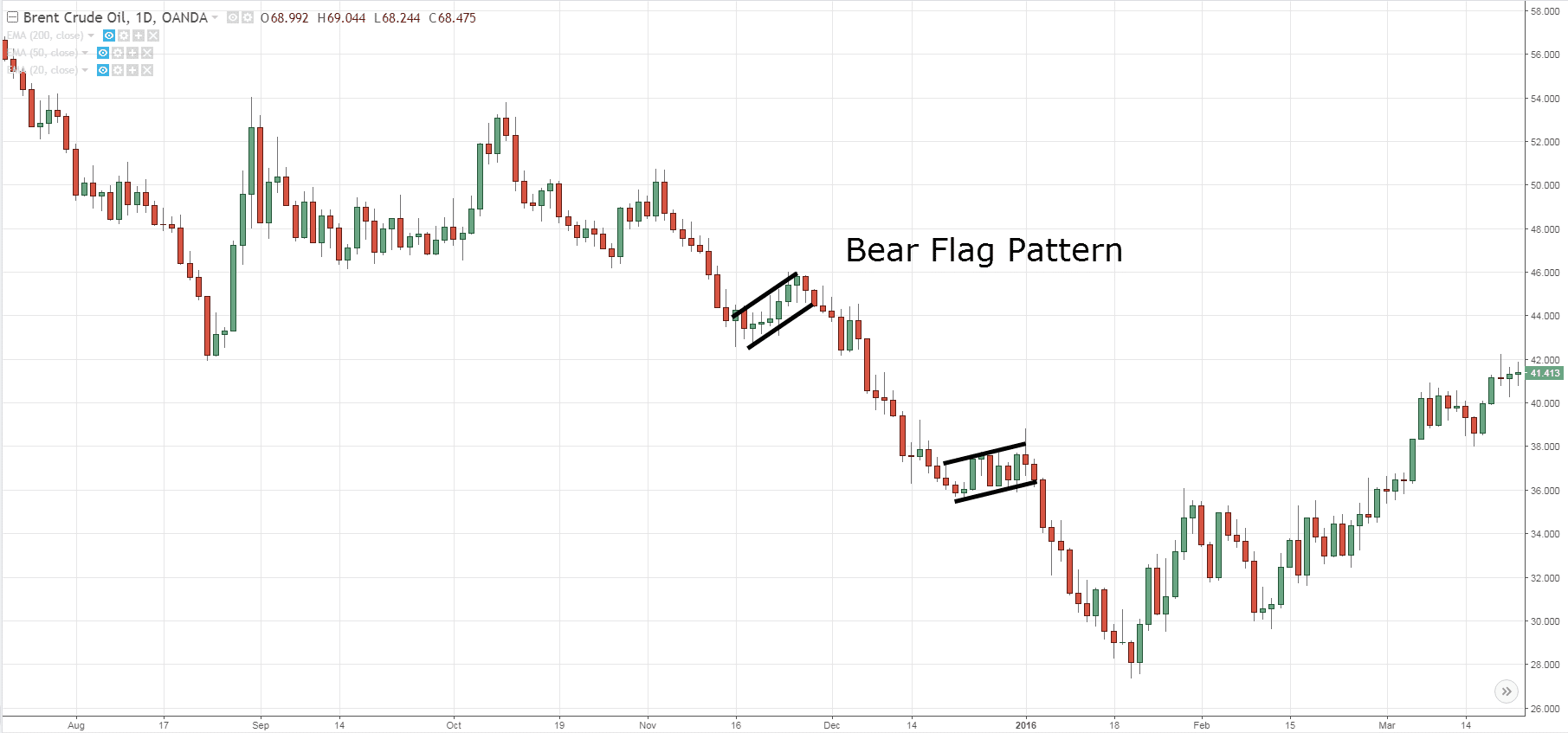

A bearish flag is the complete opposite of a bullish one it means a trend reversal at the top.

:max_bytes(150000):strip_icc()/Clipboard04-04f8217269aa464ca5694333cb77d443.jpg)

. You may say its a bull. A bull flag is a technical analysis pattern that can identify potential buying opportunities in a market. A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur.

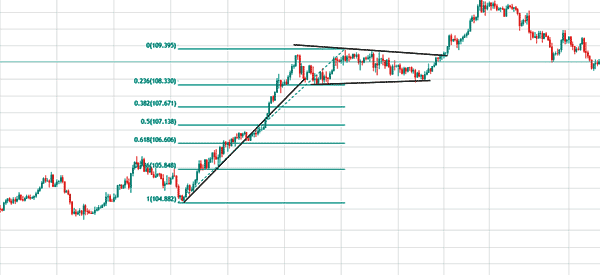

The pattern is easy. DailyTimeframe November 2021 to November 2022 CHART 1 The DXY Index appears to be consolidating in a bull flag since the. Continue Reading on Coin Telegraph.

On the weekly chart it is in a pullback phase after a strong rally from October low. The SP 500 Emini futures formed an Emini wedge bull flag on the Monthly chart. When the correction begins and the price drops.

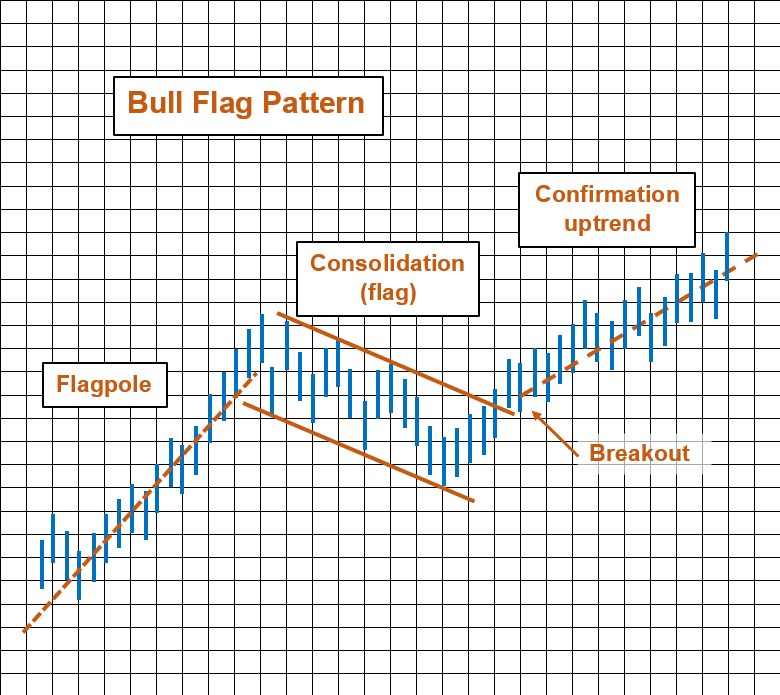

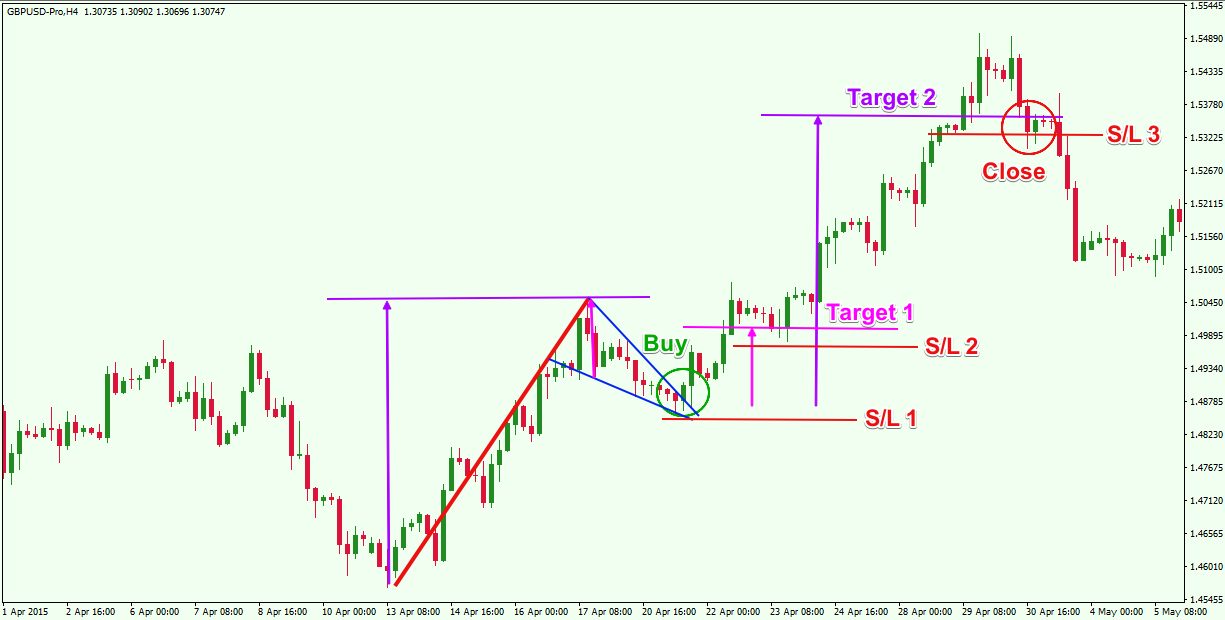

The bull flag is a continuation chart pattern that consists of two waves and resembles the shape of the flag in technical analysis trading. Nov 3 2022 New Zealand Dollar Technical Analysis. As you anticipate the breakout place a buy order or a long.

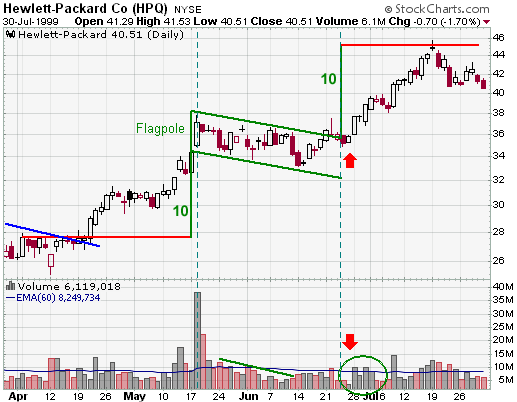

The bull flag formation is a technical analysis pattern that resembles a flag. The bull flag should have an uptrend since its a continuation pattern and isnt a reversal. The flagpole and the flag.

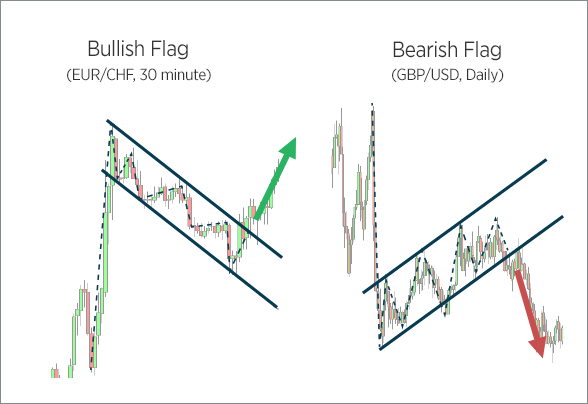

A bull flag is a widely used chart pattern that provides traders with a buy signal indicating the probable resumption of an existing uptrend. Bull flag vs Bear flag. Flag and Pennant Chart Patterns in Technical Analysis.

The bull flag pattern is a continuation price pattern. Cryptocurrency technical analysis How To Read BULL BEAR Flags Technical Analysis-3 The cryptocurrency Bull market is in full swing and this is as exciting as it is terrifying. A bull flag pattern is a type of technical chart pattern.

DXY PRICE INDEX TECHNICAL ANALYSIS. Traded properly it can be among the more reliable. There are two main price levels that make up the bull flag pattern.

Learn how to trade the explosive moves associated with the bull flag. A bull flag is a widely used. In technical analysis bull and bear flag patterns are well-known and easily recognized price patterns.

Notice the flag pattern confirming itself with a decreasing price consolidation and weaker volume. When the price of a stock or asset swings in the opposite direction. Bull and bear flags are both strong continuation patterns.

It resembles a parallelogram. When bullish flag pattern forms. This flag is bent on either side usually it represents.

It consists of a parallelogram-shaped flag. It usually occurs after a sustained downtrend and it is marked by a. A flag pattern in technical analysis is a price chart characterized by a sharp countertrend the flag succeeding a short-lived trend the flag pole.

Unlike the flag where the price action consolidates within. A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur.

Bull Flag Pattern What It Is Examples Seeking Alpha

Arps Flag Patterns Financial Market Trading Indicators Technical Analysis Programming

How To Trade A Bearish Flag Pattern

Flag And Pennant Technical Analysis Trading Signals Screening With Chart Analysis And Chart Pattern Recognition

Eur Usd Bull Flag Pattern In Wave 4 In Strong Uptrend Action Forex

-636770759222132024.png)

Gold Technical Analysis Bull Flag Sighted On Hourly Chart

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Bull Flag Chart Pattern Trading Strategies Warrior Trading

How To Trade Bull And Bear Flag Patterns Ig Us

What Is A Bull Flag Chart Pattern And How To Spot It

Bullish And Bearish Flags Learn Forex Trading Forex Com

Bull Flag And Bear Flag Chart Patterns Explained

Bull Flags And Pennants Definition Chartmill Com

Bullish Flag Chart Patterns Education Tradingview

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

The Bull Flag Pattern Trading Strategy